Is the federal debt a problem? Not according to President Obama, who believes that the debt is “not a problem in the short-term.” And not according to Senate Democrats, who have recently passed a farcical budget that includes an additional $100 billion in stimulus spending and makes no attempt to balance the budget at any point in the future.

The federal debt is certainly not a problem in the view of liberal pundits like Paul Krugman, who derides “deficit scolds” as being without credibility, or Ezra Klein, who recently published an article claiming that the problem with our recent deficits is that they are too small, not too large.

Keynesian economic theory, widely embraced by the political class, dictates that deficit spending is necessary for countries that have stagnated economically, and that some sort of stimulus is necessary in order to return them to prior levels of employment. But even the architect of this philosophy knew that his theory had limits.

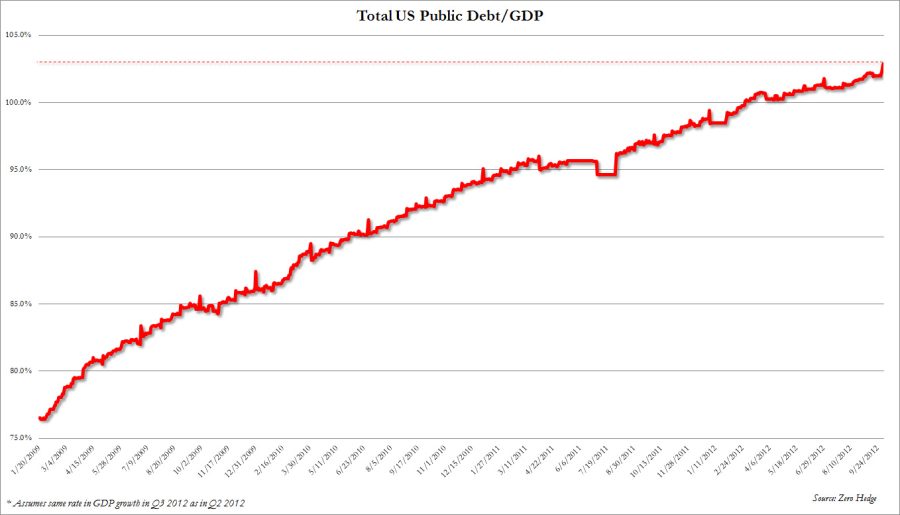

Out of control spending and debt has been the downfall of many regimes throughout history. Most famously, excessive money printing to repay debts has led to hyperinflation, as in the case of Weimar, Germany in the wake of the First World War. Threats of default, as in modern day Greece, have led to fiscal chaos and desperate imposition of austerity policies. In our own country, red ink and an aging population is threatening the solvency of our largest entitlement programs.

Paul Krugman and the pseudo-Keynesian intelligentsia of the left would respond that the debt is still a long-term problem with no short-term implications. In fact, Krugman would no doubt retort – cutting government spending in the short-term would be disastrous – cutting off the nascent recovery and sending the country spiraling back into recession.

The notion that debt has no short-term consequences is demonstrably false. Our interest payments on the debt last year, totaling approximately $245 billion, cost more than spending on education, veterans pensions, and Medicare Part D combined. An increase in interest rates seems likely, considering the downgrade of U.S. bonds by ratings agencies and general economic theory that when borrowing increases, lenders raise rates.

If this happens, spending on interest will crowd out more vital expenditures, force tax increases, and further damage our fiscal standing – pushing the country closer to chaos.

Today, massive government borrowing is crowding out private borrowers from the credit market. This means that entrepreneurs and businesses are unable to borrow to expand their businesses because the equity to do so is unavailable. This hindrance to the private sector of the economy at the behest of the public is a clear short-term detriment of massive debt that has exacerbated economic lethargy.

If only there were a politician today with the gumption of a certain young senator in 2006, who spoke vociferously against the raising of the debt limit, as proposed by then President George Bush.

“This rising debt is a hidden domestic enemy,” said the charismatic freshman. “Robbing our cities and states of critical investments in infrastructure like bridges, ports, and levees; robbing our families and our children of critical investments in education and health care reform; robbing our seniors of the retirement and health security they have counted on.”

And who was this fiscal warrior? John Thune? Ron Paul? In fact, it was the same man who has added $6 trillion to the debt since 2008: Barack Obama.

Similar hypocrisy is found in writing by Paul Krugman during the Bush Administration. Writing in 2009 in the wake of the debt left by George Bush, Krugman wrote that he was “terrified” of the current fiscal situation, and he had locked in his mortgage rate because of the inevitable hike in interest rates caused by the increased deficits.

“How will the train wreck play itself out? … My prediction is that politicians will eventually be tempted to resolve the crisis the way irresponsible governments usually do: by printing money, both to pay current bills and to inflate away debt. And as that temptation becomes obvious, interest rates will soar,” he wrote.

Obviously, debt is only a problem when a Republican is in the White House.

America has been in debt since the Jackson Administration, and running deficits is not always catastrophic and can be necessary, primarily in times of war. However, our over-reliance on Keynesian economic theory has led to a situation precariously bordering on unstable.

The burden of this debt will most likely be felt not by those currently in charge, but by the upcoming generation of Americans. Politicians today have a moral obligation to reign in spending and restore fiscal sanity. If they don’t, the American dream will be impossible to realize for future generations, in terms of living standards and wealth.