Since the first issue was released with our new amazing subsection, conspiracy theories began to breed, as they naturally do, because nice things can’t just happen without lobby groups and big money getting in the middle.

People began to say that big car companies or successful dealerships paid for this glorious subsection’s conception.

People began to say that Mass Media must be making bank on these new car articles at a commuter school, with advertising spots or something.

Some people said that this new section gave UMass so much money in advertising “conveniently placed articles” and massive automotive manufacturing payout, that Auto is to blame for the construction of new buildings and the severe lack of campus parking at Massachusetts’ largest commuter school.

Well, no one said that last thing. But the parking is a problem.

So, to all of you conspiracy theorists out there poking at our section, here’s what a nice lady working for Chrysler Jeep Dodge Ram 24 sent me over the summer.

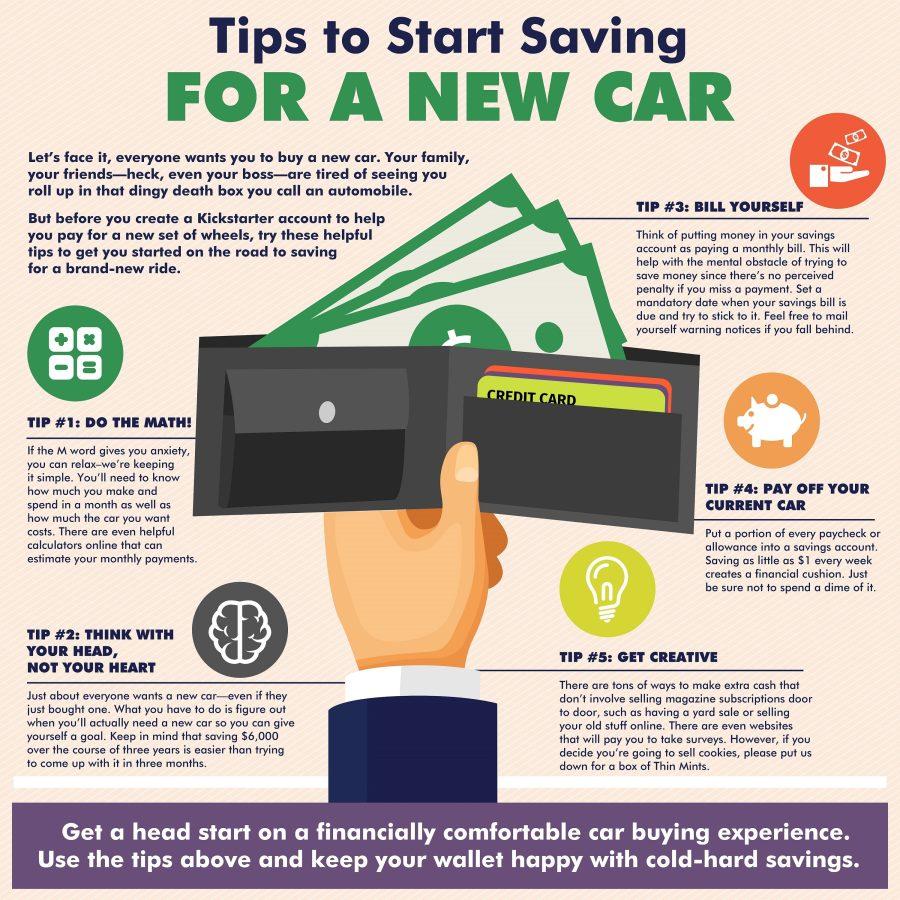

This is a money saving information guide on how to start saving for a new car.

Tip #1: Do The Math!

If the M word gives you anxiety, you can relax–we’re keeping it simple. You’ll need to know how much you make and spend in a month as well as how much the car you want costs. There are even helpful calculators online that can estimate your monthly payments.

Tip #2: Think With Your Head, Not Your Heart.

Just about everyone wants a new car — even if they just bought one. What you have to do is figure out when you’ll actually need a new car so you can give yourself a goal. Keep in mind that saving $6,000 over the course of three years is easier than trying to come up with it in three months.

Tip #3: Bill Yourself.

Think of putting money in your savings account as paying a monthly bill. This will help with the mental obstacle of trying to save money with no perceived penalty if you miss a payment. Set a mandatory date when your savings bill is due and try to stick to it. Feel free to mail yourself warning notices if you fall behind.

Tip #4: Pay Off Your Current Car.

Put a portion of every paycheck or allowance into a savings account. Saving as little as $1 every week creates a financial cushion. Just be sure not to spend a dime of it.

Tip #5: Get Creative.

There are tons of ways to make extra cash that don’t involve selling magazine subscriptions door-to-door, such as having a yard sale or selling your old stuff online. There are even websites that will pay you to take surveys. However, if you decide you’re going to sell cookies, please put us down for a box of Thin Mints.

These are actually great tips to help penny-pinch in a creative and productive manner. However, some of these seemed too nice and innocent for me so I came up with an alternative for a more extreme, and might I say more realistic, college circumstance.

Tip #1: Math.

If the “M” word gives you anxiety, then it is probably because you are facing the impending doom of crippling debt as you make it on your own in a new city. Heck, it can be the same city you’ve lived in all of your life. The only difference is that you decided to go to college, where they have no problem with slamming you with as many fees and nonnegotiable payments as they see fit, and that you moved out.

So, now for the rest of your collegiate career you take the position of Atlas under a behemoth of debt and IOUs. Not to mention that you probably now live with as many as five other people in a tiny expensive apartment who you will grow to hate over the next four months (not even a year).

But you should probably check how much you make and balance that out with how much you’re hemorrhaging money on a monthly basis.

Tip #2: Think With Your Head.

Everyone wants a new car, but maybe if you’re in college moving around the city and busy just being a young college student, a 2+2 that can’t even fit a hand bag in the rear seats isn’t for you. Yes, the FRS and BRZ twins are remarkably affordable; Mustangs, Camaros, and Challengers are as well.

But if you find that your daily commute consists of being the designated driver in and out of Boston for the five a**holes that you now live with, think about getting a sedan or a cuv.

Tip #3: Billing.

You don’t need to get in the habit of paying a new bill by billing yourself. Every company, utilities service provider, and bursar’s office is doing that for you. Just watch the bills stack up on your counter, sit in a chair, and relieve the constant stinging with a tall glass of bourbon. Just ignore it, right? It’ll all go away.

Tip #4: Pay Off Your Current Car.

PFFFFT. Like you had one.

Tip #5: Don’t Get Creative.

There are tons of ways to make extra cash, but no one wants to be bothered with the news report that you’ve gone missing trying to sell your guitar to a shady guy from Craigslist. You’re never gonna buy that new car by being stuck in that basement.

If you want extra cash, be a test subject on a study about sleep disorders and call it a day.

Tips on Saving for a New Car

September 15, 2015