When discussing money in trillions, we are often discussing things of huge proportions. Nations’ GDPs are often discussed in terms of trillions. The United States GDP, for example, is 20.937 trillion USD. (1) The largest company in the world by market cap, Apple, has a market cap of 2.3 trillion USD. Another figure that might surprise people is that student loan debt is a staggering 1.6 trillion USD. This enormous amount is a tremendous burden on the young consumers of the United States and is prohibiting them from buying homes, building their credit, and creating equity. A concept floated by many politicians involves erasing the student loan debt held by 42.9 million Americans. (2) While this policy is extreme, it is gaining popularity by many politicians as well as by the general American public.

Student loan debt is undoubtedly a large burden on the American public. As more and more Americans enter the workforce, straggled with student loan debt, they struggle to pay rent, afford housing, and purchase basic necessities, such as technology. As this burden continues to grow, politicians, particularly those on the political left, have floated the idea of erasing, or at least substantially combatting the student loan crisis.

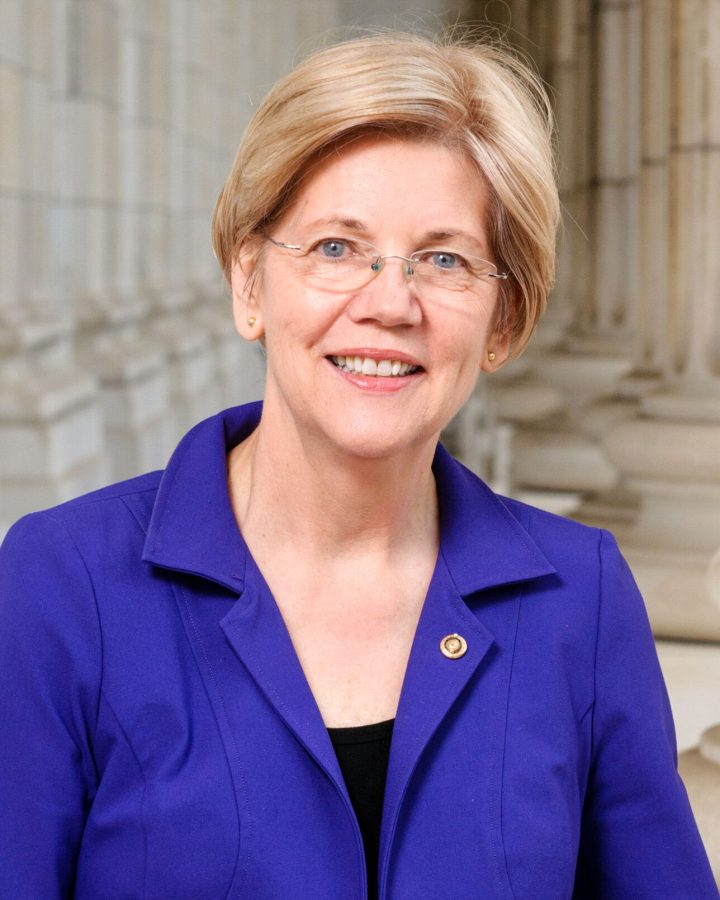

In early September, Elizabeth Warren, one of the loudest voices for this proposal, continued to push the Biden Administration to cancel student loan debt. Fortune writes, “…[Elizabeth Warren] said that Biden has the executive power to cancel student loan debt. But he doesn’t think so; he says student debt cancellation en masse needs to be done through congressional action.” (3) When Warren was running for President, she heavily pushed for this policy, and while her presidential run was eventually unsuccessful, she continues to push for these policies through the halls of Congress. So what exactly are the economic and fiscal ramifications of canceling student loan debt?

One of the first and most simple ramifications of canceling student loan debt would be releasing a huge amount of the American public from crippling debt. A staggering one in eight Americans has student loan debt. (4) With capital now freed up to buy goods and services, many Americans would be happy to see their paychecks no longer decreased by hundreds of dollars a month. Forget a stimulus check, legislation that would release this 1 trillion dollars of debt from the American people would substantially stimulate the American economy for several years as Americans find themselves freed from debt.

As a result of this canceling of debt, two main questions are asked: who now assumes this debt, and what about those who did not choose to take out loans to pay for college? The first is much easier to answer than the second. This debt would immediately become the debt of the United States Government. Currently, the United States National Debt is a staggering $28 trillion (5), so an additional 1 trillion is substantial but not devastating. In many cases, we are encouraged by the US government to take out such staggering loans to pay for our degrees, and it is actually through these loans that college has become more expensive. For more information, please read “How Unlimited Student Loans Drive Up Tuition” by Preston Cooper on Forbes: https://www.forbes.com/sites/prestoncooper2/2017/02/22/how-unlimited-student-loans-drive-up-tuition/?sh=246dd4a52b63.

The United States should take responsibility for these loans and free up the wallets of so many struggling American families. Secondly, regarding those who did not take out loans, this should be assessed on a case by case basis. Low-income families who may have paid off their loans should apply for loan reimbursement. However, I believe many of those who already paid for their college loans may not be able to recover the money they paid.

Many Americans are indebted to loan sharks and companies that manage federal student loans. And while the economic and fiscal ramifications cannot be assessed fully unless the policy is implemented, economic analysts should continue to study the situation. However, one thing is clear, the United States government has a moral and economic responsibility to deal with this situation because, in reality, it is not just a situation but an economic crisis of huge proportions.